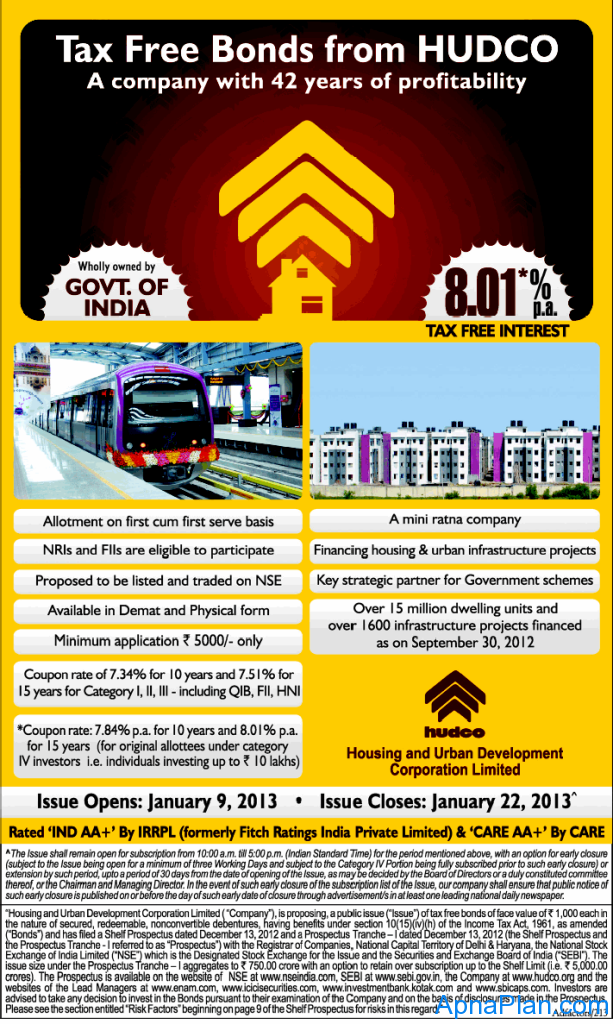

After Rural Electrification Corporation (REC), Power Finance Corporation (PFC) and India Infrastructure Finance Company (IIFCL) Tax Free bonds, another Government-controlled company – Housing and Urban Development Corporation (HUDCO), is issuing tax-free bonds between January 9 and January 22, 2013.

HUDCO Tax Free Bonds – Significant Points:

- Offer Period: January 9 – January 22, 2013 (the offer can be pre-closed on full subscription)

- Annual Interest Rates for Retail Investors:

- 7.84% for 10 Years

- 8.01% for 15 Years

- The interest rates are 0.5% less for HNIs, QIBs and corporate subscribers.

- Price of each bond: Rs 1,000

- Minimum Investment: 5 Bonds (Rs 5,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Reservation: 40% reserved for retail investors

- NRIs can invest: Like the IIFCL issue, NRIs can invest as retail investors or in the other category for the HUDCO tax free bonds.

- Rating: CARE AA+

- Allotment: First Come First Serve

- Listing: Bonds would be listed on NSE and will entail capital gains tax on exit through secondary market

- You can apply for these bonds in the Demat or the physical format, but for trading you need to have them in the Dematerialized format.

- Step Down Clause: The bonds will come with a step-down clause, according to which only the original allottee, who has subscribed under the retail category will receive the coupon of 7.84% – 8.01% depending on tenure. On sale or transfer, the benefit is lost and rates reduce to that applicable for other investors (7.34% for 10-year bonds and 8.01% for 15-year bonds).

Why you should invest?

- HUDCO is offering interest of 8.01% to retail investors for 15 years tenure. This is the highest so far.

- The bonds are secured to the full extent and have the good credit rating (AA+). The other tax free bonds launched recently had credit rating of AAA. I don’t see this as a major issue as HUDCO is totally government owned and the default risk is almost negligible.

- The interest rates on future tax free bonds might be lower as RBI might moderate its policy rates from January 2013

Why you should not invest?

- The interest rate offered by PPF is 8.8% tax free. You should exhaust your maximum PPF limit of Rs. 1 Lakh before you look for tax free bonds

- If you are not in higher tax slab of 20% or more

HUDCO Tax Free Bonds – Who should apply?

As for most tax free bonds, these are good for investors in high income tax bracket of 20% and 30%. Today the maximum rate offered by bank fixed deposit is 9.5%. This translates into a post tax return of 7.82% for 20% tax slab and 6.8% for 30% tax slab. This is lower than HUDCO’s 10-year and 15-year tax free bonds.

Along with the above, it suits investors who want regular income from interest payment and have low risk profile.

Also its widely speculated that RBI would lower interest rates very soon, and if it happens this would be last issue this year to offer tax free interest rate of more than 8%. So in case you plan to invest in any tax free bond, HUDCO might be a good pick.

About HUDCO:

Housing & Urban Development Corporation Ltd. (HUDCO) is a public sector company fully owned by Govt. of India for financing of housing and urban infrastructure activities in India. HUDCO was incorporated on April 25, 1970.

HUDCO Tax Free Bonds – Jan 2013 Advertisement:

HUDCO Tax free bonds should be offering highest interest as of now and I don’t think anyone is going to launch tax free bonds at higher rates in near future.

I agree with your assessment. IRFC is next in line and their interest rates are lower than HUDCO. But note that HUDCO has slightly lower rating than others and hence higher interest rates.