Several NPS subscribers received SMS on April 27 from NSDL stating – “As a regulatory requirement, submit FATCA self-certification for your PRAN to CRA, else account will be frozen. For more details visit www.npscra.nsdl.co.in”

FATCA declaration for NPS can be done Online now – Click to Read!

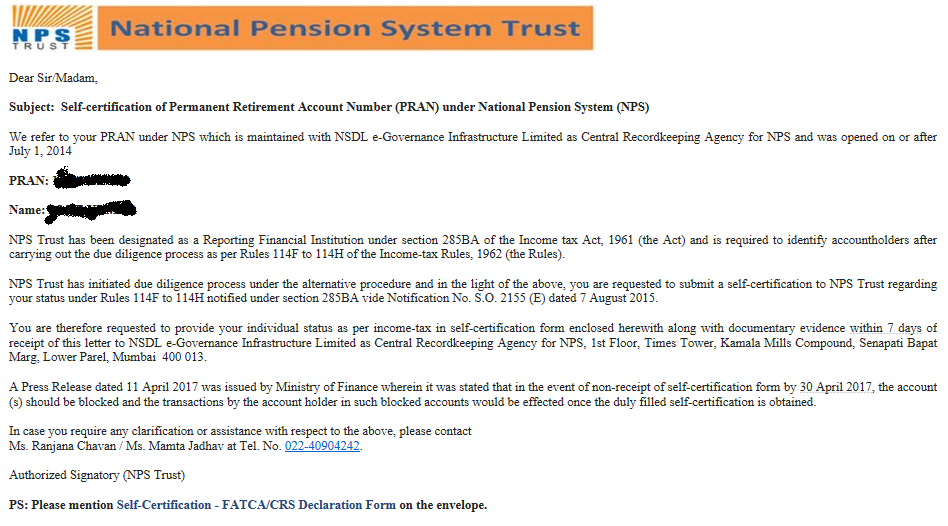

Later in the day subscribers also received from NPS [email protected] on their registered email with Subject: “Submission of FATCA Self-Certification Form for your PRAN under NPS”. Have reproduced the mail below.

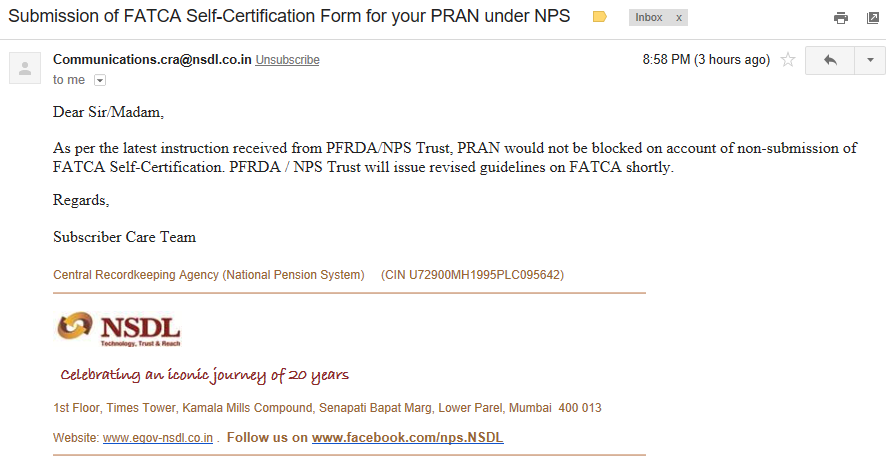

New email from NSDL:

A few hours back received below mail from NSDL. The accounts would not be blocked on account of non-submission of FATCA Self-Certification. PFRDA / NPS Trust will issue revised guidelines on FATCA shortly. So NPS subscribers should wait until further instructions.

NSDL handled this entire thing in worst way possible – some heads should roll!

What is FATCA?

FATCA is Foreign Account Tax Compliance Act, a law enacted by USA in 2010. According to this law, any individual who is resident of USA (citizens or green card holders) or financially connected to the US or have any tax residency in US have to declare all their foreign income and investment details to US Tax Authorities. The law was enacted to prevent tax evasion through offshore investments by US residents.

India is signatory of the above law and hence all the financial entities like Banks, Insurance Companies, Mutual Funds, Brokerages, etc have to furnish their client information to the Indian Government, which in turn would share it with US Government. In case you have no income connection with USA, you are not impacted but still need to give the declaration.

NPS FATCA Declaration:

Unfortunately PFRDA the regulator for NPS did not bother to inform its subscribers about the FATCA requirement until the very last minute. But regulations being regulations this is what we need to do.

Only people who have opened NPS Account on or after July 1, 2014 are impacted.

But with tax incentive on NPS coming in 2014 there would lot of people who opened NPS account and would be impacted!

Also Read: Should you Invest Rs 50,000 in NPS to Save Tax u/s 80CCD (1B)?

To comply subscribers would have to submit a self-certification (i.e. FATCA/CRS Declaration) to NPS Trust.

Step 1: You can download the NPS FATCA Self Declaration Format by clicking here or from the email you received.

Step 2: Fill up the form (How to fill the form has been shown below) and send it to Central Recordkeeping Agency (CRA) for NPS at the following address:

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

Also mention Self-Certification – FATCA/CRS Declaration Form on the envelope

In case the above filled self declaration NPS FATCA form is not received before April 30, 2017 the NPS account would be blocked. The account can be activated only after subscriber submits the above form.

Also Read: 5 Steps to Transfer EPF to NPS

How to fill NPS FATCA Self Declaration Form?

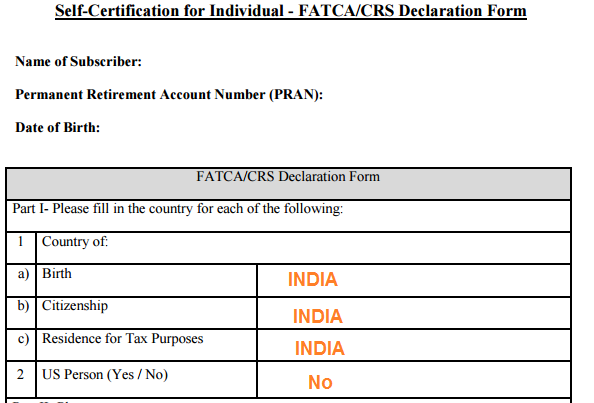

The FATCA form is 3 page form divided in 4 parts.

Part I:

Part 1 asks for following information:

Name of Subscriber:

Permanent Retirement Account Number (PRAN):

Date of Birth:

1. Country of:

a) Birth

b) Citizenship

c) Residence for Tax Purposes

2. US Person (Yes / No)

In case the answer for 1 above Country of Birth, Citizenship and Residence for Tax Purposes is INDIA, you just need to move to Part 3 for signature. This hopefully would cover majority of NPS subscribers.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

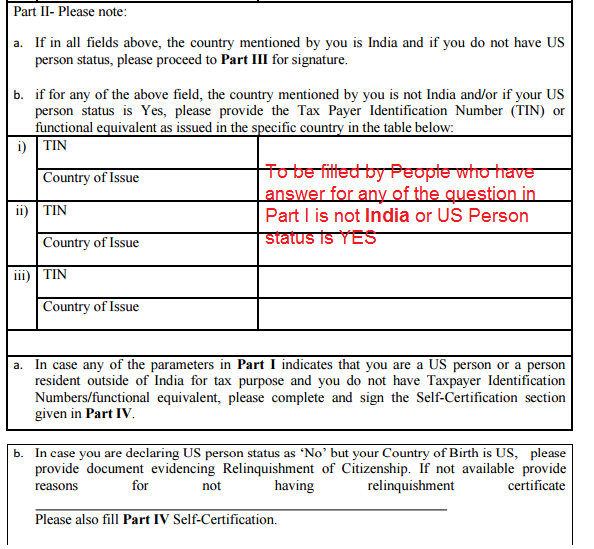

Part 2:

In case the answer for any of the above is not India or US Person status is YES, you need to provide Tax Payer Identification Number (TIN) or functional equivalent as issued in the specific country in the table.

Also Read: 6 Changes in NPS Rules in 2016 & How it Impacts You?

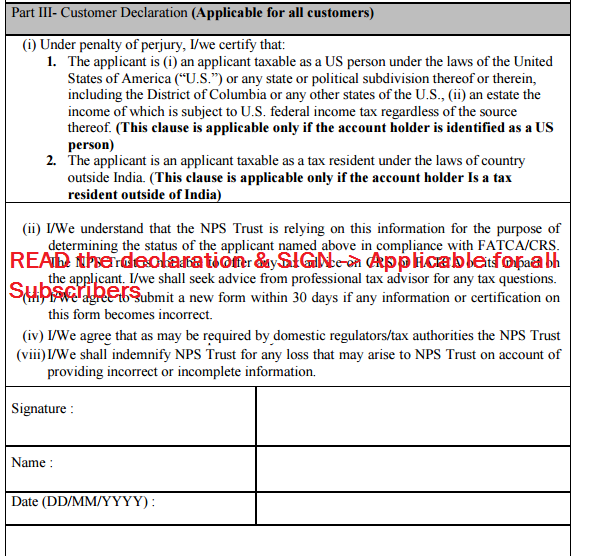

Part III:

Part III just requires your name, signature and date and is to be filled by everyone.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

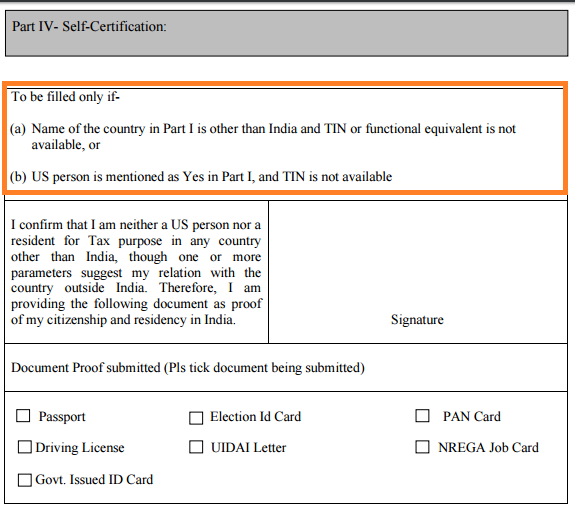

Part IV:

Fill this part only if you satisfy conditions below:

Name of the country in Part I is other than India and TIN or functional equivalent is not available, or

US person is mentioned as Yes in Part I, and TIN is not available

Download: Ultimate Tax Saving ebook with tax calculator FY 2017-18

The subscribers would in this case have to provide any of the below mentioned as proof of citizenship and residency in India.

- Passport

- Election ID card

- PAN Card

- Driving License

- UIDAI Letter

- NREGA Job Card

- Govt. Issued ID card

In case you require any clarification or assistance with respect to the above, please contact Ms. Ranjana Chavan / Ms. Mamta Jadhav at 022-40904242.

The Problems:

The entire approach by NPS/NSDL to obtain FATCA declaration is going to create lot of issues for subscribers. I do not understand why this could not be done online as was done by Mutual Funds earlier. Also there is NO way subscribers would be able to send the FATCA self declaration forms on time. Even in case they do NPS CRA would not have the ability to process the deluge of forms! Anyway as subscriber send this FATCA Self declaration as soon as possible to prevent any problem in future.

Is this for all . I have no income from any other country .. so I also have to submit . If not submit then is there any problem.

Yes every subscriber has to submit. In case you do not by April 30 your NPS account would be blocked and only reactivated when you submit the FATCA declration

Thanks Amit for explaining in detail. My question is how should send the declaration – ordinary post/ speed post or courier?

There is NO mention on NPS site about how to send. I think speed post should do.

Hi Amit. But part 3 clearly asks us to certify that we are either 1) US person or 2) tax resident outside India. I am neither, so how do I sign part 3?

Its mentioned in header of Part 3 “to be signed by all customers”. Also the signature is for the long list of declarations!

Do we have to submit the photocopy of pan card/voter-id card when we don’t have to fill part IV

No

why should anyone agree to Para vi of part 3 – “I/We permit/authorise NPS Trust to collect, store, communicate and process information relating to the Account and all transactions therein, by NPS Trust and any of its affiliates

wherever situated including sharing, transfer and disclosure between them and to the

authorities in and/or outside India of any confidential information for compliance with

any law or regulation whether domestic or foreign.”

specially to sharing confidential information with foreign authorities when he is Indian and has no connection to US???

🙂 Well there are lots of questions in everyone’s mind about such declarations. I think you should write/talk to the contacts mentioned in the post.

Thanx Amit..

Photocopy of photo id proof should it be self attested?

Instructions do not say so but self-attestation is NOT bad idea.

Can I send form through speed post

Yes

does indian citizens also have to attach documents? or they only need to send the filled form?

Only fill up the form – no documents needed

Thank you for providing timely information

Hi Amit Thanks for the post. I have a doubt. In Part IV Self Certification should an “Indian Citizen paying tax in India” sign or not? Also should everyone submit an identity proof while sending the performa?

As per instructions Part 4 is not required to be signed by Indians. List of documents too are for Part 4. So with all 3 answers as India no documents are required to be attached.

Thanks

In Part 1, the “US Person (Yes / No)” should be filled based on the person’s status as of today or one should take into account the status in the previous year’s as well? I ask this because I was in US previously and have filed tax returns there because I was a “US Person” as defined by IRS (residing for more than 183 in a calendar year). So, for that year, i was US person, but as of now i am not since i have returned from the US and no longer an US person as defined by the IRS

The declaration asks for the present status and hence your tax status as of today matters. So you are not US Person

pathetic it is, online would have better,

Thanks for the speedy post. It was really helpful.

Thanks Amit for the explanation. I completely agree with you that they could have done it online(at least for Just INDIAN in part I)

Another addition in To-Do list :(.

Yup this is bad and timed even badly!

Should we send it personally by post or via treasury?

Via Post. Not everyone can visit personally anyway.

Thank Amit, it was really helpful. However i have one question, Residence for Tax Purpose for US residents should be USA?

Yes with relevant Tax Payer Identification Number