In last few weeks I have got several mails and comments asking about the tax benefit on NPS. This post explains the tax deduction availa/ble for NPS under 3 sections: 80CCD(1), 80CCD(2) and 80CCD(1B).

Tax Benefit on NPS Tier 1 and/or 2?

NPS has two Tiers – 1 and 2.

NPS Tier 1 is the long term investment, which has restricted withdrawals and meant primarily for retirement planning. On maturity, you can withdraw maximum of 60% of corpus as lumpsum and rest has to be used for annuity purchase.

NPS Tier 2 is for managing short to medium term investment. You can invest and withdraw anytime as per your wish. This is an optional feature and you are asked if you need Tier 2 account while opening NPS.

All the tax benefit related to NPS is available to investment in NPS Tier 1 account only.

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

NPS Tax Benefits:

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). We discuss each below:

1. Section 80CCD(1)

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction. [This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction]. Self employed can also claim this tax benefit. However the limit is 10% of their annual income up to maximum of Rs 1.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction. This was introduced in Budget 2015.

Also Read: Should You invest in NPS to take tax benefit u/s 80CCD(1B)

3. Section 80CCD(2)

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section above the Rs 1.5 lakh limit in Sec 80CCD(1). This is also beneficial for employer as it can claim tax benefit for its contribution by showing it as business expense in the profit and loss account. Self employed cannot claim this tax benefit.

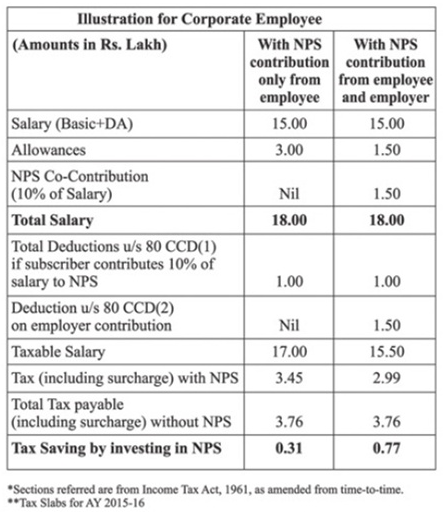

Below is the illustration on how introducing NPS can help you save tax under Section 80CCD(2).

Tax Benefit for Compulsory NPS deduction:

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer too contributes the matching amount. The confusion for most employees is how they take tax benefit on their compulsory NPS deduction?

Here is an example:

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Let’s take the easy part first. Employee’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I hope this would have cleared the confusion on how NPS helps you save tax.

Sir

I am govt. Employee I invest 72000 in NPS tier 1 I have invest 125000 in various lics and other schema for rebet under 80c .Can I claim 50000 under 80ccd1 and remains 22000 under 80c and how

Yes you can claim 50K u/s 80CCD(1B) and 22K of NPS as 80C. You just need to submit the relevant proofs to employer. Also mention the same while filing your income tax return.

Sir, I am a central Govt. employee with NPS holder. My total savings are:

LIC–52000

PLI–100000

Employee’s contribution under NPS — 62000

Employer’s contribution under NPS — 62000

Sir as my inverstiment u/s 80C is 150000 (LIC+PLI)

Wjether can I show my NPS contribution u/s 80ccd(1B)

Please, clarify my issue.

Thanking you sir.

Yes you can show your investment up to Rs 50K u/s 80CCD(1B)

sir, i contribute rs 51967 as 80ccd(1)+360 as cgis+rs 54276 as lic+14400 as tution fee=121003 under section 80 c also 51967 contribute from employeor .my total salary is rs 623579 . then hhow much my income tax occured in ay 2017-18

Hello,If I claim 150000 under section 80c excluding NPS and invest 50000 in NPS and then availed the same under section(80 ccd 1b) do I still have to pay 10% of my (BA +DA) to employer?can I just not invest 50000 as my own contribution to NPS without involving my employer.please let me know.Thanks.

The employer contribution comes into play only if your employer has option of NPS. Not all employers offer NPS. For 80CCD(1B) you can either consider your contribution through employer or you can self-invest. But if your employer is offering NPS it has to compulsorily submit 10% of Basic + DA as its own contribution.

I have used 1.5 of 80C with other than NPS instrument . Can I claim the additional 50 k exmption under 80 CCD(1B) as well as employer’s contribution under 80CCD1 . i.e 1.5 + 50 K + employers contribution and if this total amt goes above 2 lacs for e.g if the amount comes to 2.75 lacs then is the entire amount of 2.75 lac is allowed as tax exemption or only 2 lac is allowed.

The maximum limit is Rs 2 lakhs!

Hello sir,

As u say before that No you’ll get tax rebate only on your contribution. The employer contribution is anyway tax free.

When someone merge both amount employee and employer contribution and take tax benefit and form 16 also generated the same, how can be manage.pls help..?

Employer contribution is not shown in Form 16. You cannot merge both to take tax benefit

Sir i am gov. Job my nps account open add. 50000 no labh kevi rite male.

Sir,

My contribution from my salary to NPS is Rs. 48000 and the same amount is contibuted by my employer.

So, will I get the tax rebate on the amount contributed by my employer??

No you’ll get tax rebate only on your contribution. The employer contribution is anyway tax free.

But i have got form 16 with the total amount contributed towards NPS by adding mine and employer’s contribution i.e. Rs. 96000 , then how should i file it in ITR and under which section??

Just ignore the employer contribution and deduct it from the gross salary while filing your returns.

you keep gross salary as in form 16. Just you need to do is you deduct 48000/- in section 80CCD(2) while filing return. It will not have any impact on your tax liability.

I have used 1.5 of 80C with other than NPS instrument, further invested 50000 under 80CCD(1B) and 30000 (10% of basic)…so total eligibility for tax exemption will be 80K???

The 10% of basic contribution to NPS qualifies u/s 80CCD(1) which along with u/s 80C has total limit of Rs 1.5 lakhs. So you will qualify for Rs 1.5 lakhs and additional Rs 50K for NPS u/s 80CCD(1B)

sir i am bank employee since 1999 having pension option.now my query is that can i open NPS for which i can get income tax deduction under 80 cc(d). please clarify

Yes you can open NPS account and can get benefit u/s 80CCD(1B) only up to Rs 50,000

Sir,i have submitted form of income tax return in my department.i had rs.1265 as taxable amount. And i had 3580 rupees as refundable amount from advance income tax deductions. I had mentioned refundable amount with negative sign (-3580) in form submitted. But wrongly refundable amount of 3580 has been deducted from my salary of the February month.

i had nil taxable amount due to advance deduction of income tax.and now 3580+3580=7160 amount is my refundable amount.

How can i get this?i didn’t submit online income tax return. Please help me.i have no idea about all these.

Do not worry, just file your income tax return online and you’ll get your excess tax back in few weeks!

How can i do it?please send me link or site.efiling income tax return and e-filing income tax refund ,both are same or different?

Yes both are same. You have to file income tax return to get refund of excess taxes paid/deducted! You can read about tax filing here.

Hello, I am 30. I am contributing under different sections under 80C like NPS(50000), LIC(75000), ELSS(25000) which sums up to 1.5 Lakh.

Can I contribute another 50000 toward NPS 80CCD(1B) ? Please bare in mind I am already contributing 50000 toward NPS under 80CCD (1)

You can claim 50K investment in NPS benefit u/s 80CCD(1B) and 50K NPS you were claiming in 80CCD(1) can be replaced by other 80C tax saving investments.

Sir, is it true that the contribution by an employer towards NPS for an employee is to be treated as expenses by the employer in the employer’s company profit & loss account? If yes than is it not true that both employer gets benefit (by treating as expnenses) & the employee gets tax benefit under sec 80ccd (2)? Please reply. Thanks

That’s true and it was done to encourage NPS. The calculation in the article is from NPS advertisement published by PFRDA.

Thank you for your Reply Sir

Sir. I am state govt employee my contribution in NPS are 44000 per year, my employer also contribute same amount in my NPS account but employer contribution not shows in my salary slips or form 16. I want to know that am i add employers contribution in total income or simply fill the 80CCD1 bcoz only employee deduction is shown in ky pay slips ?

You need not add employer contribution to your income as its tax exempt. Just follow your form 16

Hi Amit, I have query that my gross income is Rs 15 lakhs and I am central government employee. Presently, I have invested Rs 1.5 lakh under 80C and additional Rs 50,000/- under 80 CCD(1B) i.e. NPS tier 1. Now, I am want to know that is there any scope of saving under 80 CCD(2).

80CCD(2) is tax exempted employer contribution. You cannot do anything about it.

I have exhausted my 1.5 lakh 80C with LIC and PPF;

1) I want to invest addtional 50,000 in Corporate and

2) 50000 in Individual NPS Tier I Acccount’

Do i get the total 2,50,000 exemption from tax? Please advice

No You’ll get max of Rs 2 lakh exemption.

Hai Amit,

My 80C 1.5 lakh deductions are already exhausted through PPF, LIC and SSY. To reduce tax I am planning to take NPS. If I am contributing Rs. 60,000 on next year in NPS, then can I avail the benefit of section 80CCD(1B). Please advice.

Yes you can up to Rs 50,000 u/s 80CCD(1B)