This post covers SBI Recurring Deposit Interest Rates, features, maturity amount along with other details. Recurring Deposit is a good way to accumulate money for any goal in safe and consistent manner. You deposit a fixed amount every month and at the end of it – on maturity you get your principal and accumulated interest.

SBI Recurring Deposit Scheme – Features

- The tenure of SBI recurring deposit may be from from 12 to 120 Months – in multiple os 3 months like 3, 6, 12, 15 months and so on.

- SBI RD is available both online and in Offline mode in all branches

- Nomination facility available

- The minimum amount of monthly instalment shall be Rs 100.

- There is NO limit on maximum amount you can deposit in RD

- The amount of instalment and number of instalment can not be changed after opening of the account.

- Loan against security of the balance in the Recurring Deposit accounts available to the extent of 90% of the deposit, at 0.5% p.a. above the rate of deposit

- TDS (Tax deduction at source) at the rate of 10% is deducted, if the interest income is more than Rs 40,000 in financial year

- Passbook Issued

- Hassle free premature spot payment anytime

- Senior citizens get up to additional 0.80% interest rate (Customers with age greater than 60 years are Senior Citizens) depending on the tenure of RD

- Can open RD online in SBI through e-RD feature in SBI internet banking

- Charges for RD pre-mature closure – Interest will be applied on premature withdrawal of RD at 1.00% below the rate applicable for the period the deposit has remained with the bank.

- The SBI Recurring Deposit account can be transferred from one branch to other.

SBI Recurring Deposit Interest Rates 2021

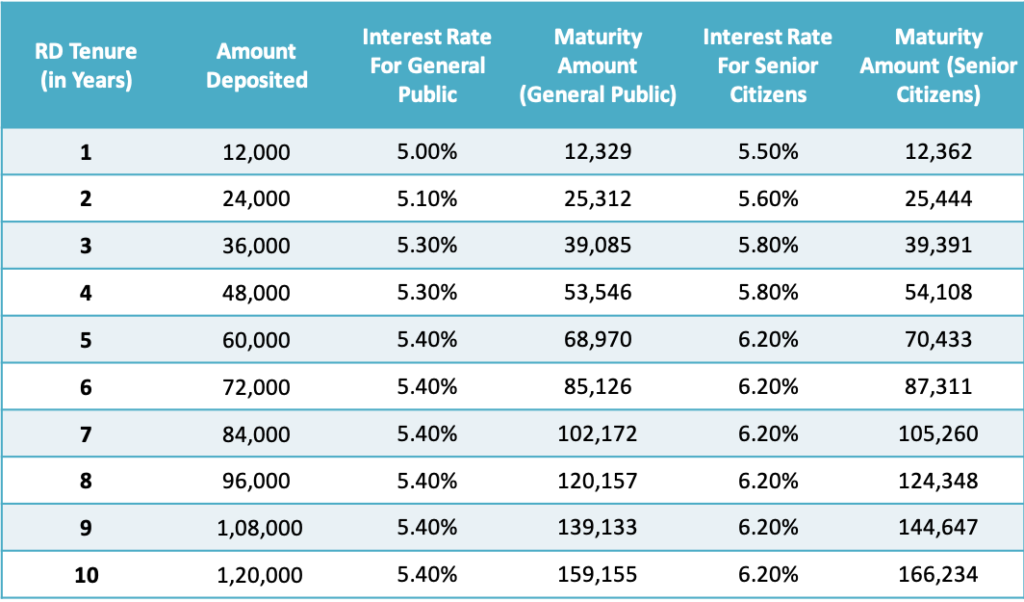

SBI Recurring Deposit Interest Rates has been last revised on 8th January 2021. General Public can get 3.90% – 5.40% while senior citizens get 4.40% – 6.20% depending on the tenure of deposit. The table below gives the details.

SBI Recurring Deposit Interest Rates 2021 & Maturity value

The table below shows SBI Recurring Deposit Interest Rates & the maturity value for Rs 1,000 monthly deposit for general public and senior citizens for 1 to 10 years.

How to Calculate Maturity Amount on SBI RD

The interest on SBI Recurring Deposit is compounded quarterly and is computed using the formula below.

M=R[(1+i) (n-1)]/1-(1+i)(-1/3))

Where, M = Maturity value

R = Monthly Instalment [60 for Post office RD]

N = number of quarters (tenure) [20 for Post office RD]

i = Rate of interest/400Helpful Posts on Recurring Deposits

- Which bank offers Highest Interest Rate on Bank FD?

- 13 Most Important things to know before investing in Bank Fixed Deposits

- Section 80TTB: Senior Citizens can Save Tax on their Interest Income

- TDS threshold on Bank FD increased to Rs 40,000 from April 1, 2019

- Avoid TDS: fill Form 15G and 15H

- Small Bank FDs offer interest up to 9% – Should you invest?

- How SWP in Debt Funds generate higher returns than FD

- How to increase bank deposit insurance through Joint accounts?

- How Safe is Your Fixed Deposit in Bank?

- How you loose Money in Fixed Deposits?

- Fixed Deposits that you can use to save Tax

- Fixed Deposits for NRIs

- Highest Interest Rate on Recurring Deposits

- Understanding Compounding and Yield in Fixed Deposit

- How to get Credit card against Fixed Deposit?

- 7 High Rated Companies Offering more than Bank Fixed Deposits

- All about Post Office FD Schemes

Who should open SBI Recurring Deposit Account?

SBI Recurring Deposit suits someone with consistent regular income (like salary) and would like to accumulate certain amount for a goal without taking much investment risk. An example could be if you want to buy car in next 2 years, you can easily open a RD account with any leading bank and start saving. If you deposit Rs 5,000 every month for 2 years at 7%, you would get about Rs 1,29,000 at maturity. This would be good for downpayment of the car.

It’s also for someone who may not have lump sum amount available for fixed deposit but would like to lock prevailing higher interest rate for long period of time. An example situation is – In March 2013 SBI was offering 9% interest rate on their recurring deposits for 10 years. I had opened a RD with Rs 5,000 just to lock a high interest rate for 10 years. On maturity I would get about Rs 9.7 lakhs – which is good accumulated amount. As of today SBI is offering 5.4%. So I have a good investment. It’s always good idea to lock when interest rate cycle reverses and it goes high.

SBI RD Penalty for Default in Instalment Payment

Whenever a depositor fails to pay the instalment on due date for three consecutive months a service charge of Rs 10/- is applicable. Penalty in case of delay in payment of instalment of RD of 5 years or less shall be Rs 1.50 for every Rs 100 per month and Rs 2.00 for every Rs. 100 per month for the account on more than 5 years. For example, if you deposited Rs 1,000 every month in SBI RD for less than 5 years maturity – If you miss payment for 1 month, you will need to deposit that instalment next month with Rs 15 as penalty (1.5 * 1000/100). If the same RD was for more than 5 years tenure, your fine would be Rs 20.

In case there is no instalment payment for six consecutive months, the SBI recurring deposit account would be closed and the available balance would be paid back to the linked account.

sir i diposit 10000 per month from july 2015 for 2 years.after 2 years how much i get

At 8% interest rate you would get Rs 2.61 lakhs after 24 months

Mahesh S,

dear sir every month Rs, 4000.00 will pay the RD account, after 2year how much will get.

At 7.5% interest, recurring deposit of Rs 4000 per month for 2 years would give you about Rs 1,03,820

Hi Amit ,

If am opting RD for 1 year & amount is 10 k/month & after 6 month only 60 K has been deposited but now i want to withdraw 60 K , so how much i will get ?? more than 60k or less than 60k ??

In case of pre-mature withdrawal in case of Recurring Deposit in SBI, you will get 1.00% below the rate applicable for the period the deposit has remained with the bank. So for example SBI offers 6% for 6 months deposit, you will get interest of (6%-1%) i.e. 5% on your RD.

So in your case you will definitely get more than Rs 60K.

Dear sir,

I am depositing Rs : 6000 per month My RD 3 Years the final amount what should i get .

At 8.5% interest you would get about Rs 2.5 lakhs at the end of 3 years on RD of Rs 6,000 per month.

I have one RD account I deposit its installment from my salary account deduction but now salary has not been deposited so i have to fail deposit my current month installment. what will happen sir

Depending on the terms and conditions of the bank, there would be nominal fine. You should deposit this missed installment along with the fine as soon as possible.

I opened an Rd this month on 19-08-2015. if the due date for my next installment is 19-09-2015, then what would be my payment start date? Meaning earliest by when can I deposit the amount so that it will be considered for next installment?

I am not sure about this, so you will need to confirm with the bank. But according to me deposit made after the installment date (in your case after 19-08-2015) should be considered as your next installment.

The ideal process should be to set up auto-debit for Recurring Deposit. In this you would not have to worry about RD installment date and missing payments.

Sudam

Sir pleases tell me now this month i start RD account… when i m having saving account in SBI……. & pls tell me how much interest i will get on RD of 25000 per month for 1 year.(or on maturity)

You will get 7.75% interest rate (non-senior citizen). So on Rs 25,000 RD per month your maturity value after 1 year would be Rs 3,12,800 and the interest gained would be Rs 12,800.

Can i close my rd account in sbi without completing my 1 year. i deposit the money for 4 months

Yes you can with applicable penalty if any

sir, i am senior citizen,at present operating RD account no 34011224143 w.e.f 02-08-2014 maturity date 02-09-2015 @ Rs 8,000/- for 13 month,please calculate maturity amount.

My next RD investment @ Rs 12,000/- for 14 months w.e.f Oct 2015,please suggest any substitute for investment.

Thanks

op srivastava

As you have not mentioned the interest rate I cannot calculate the maturity amount. The alternative investment options can be SIP in mutual funds or NCDs. But then it depends on a lot of factors like – Whats your returns expectation, the risk you want to take, how you would use the money, etc

Amit pls tell me that how can i start RD account… when i m having saving account in SBI……. & pls tell me how much interest i will get on RD of 2000 per month for 1 year.(or on maturity)

You can start RD account either online or visiting your bank branch. At 8.5% interest rate and depositing Rs 2,000 per month you would get Rs 25,127 on maturity

Rs 3000 which I planning to invest in a RD account in SBI how much amount do I get at the end of the year? Any other bank give more tnterst rate than SBI

You can view the latest RD rates across banks by Clicking here

nice information sir.. sir mujhe ek bat puchni thi apse. jaise k agar main 100 repee se sbi rd start karta hun to kya mujhe sir 100 he dene honge per month. kya mai 500 ya kabi kabhi 1000 bhi invest kar sakta hun bich bich mai. to mujhe kis hisab se interest milega. pls advise.

In most cases banks allow a fixed amount for the entire tenure. However there are products from different banks where you have option to invest flexible amount every month.

iWish flexible RD from ICICI bank is one such product. You might want to look other bank’s website to find out more

i have invested in non convertible secured bond ( kosamattam) for 3 year, and it is in demat form, if I want to sell what is the procedure, it is listed in BSE. another information required is , if I started invested in mutual fund say for 3 or more years, do I need to change the fund by checking their performance because I am not a expert or stay invested in the same fund and wait till the end of the period

You need to follow the same process for selling a NCD as you do for shares in demat account.

If you think you are not able to select the right mutual funds you should consult financial advisers. B’coz if you are able to select your first set of mutual funds for investment yourself, you can also track it and change it if required. If not I strongly suggest you consult an expert!

Hi,

Can you pls suggest me few mutual fund(sip).i want to invest it for 5year.monthly around 5k.pls suggest with approx return value.

how to calculate RATE OF INTEREST of recurring deposit.

Suppose I’m investing 2500 per month in recurring deposit account for 2 years with rate of interest 8% compounded quarterly. Now I have to find out MATURITY AMOUNT. For this i will use formula :

ACTUAL AMOUNT (MATURITY AMOUNT) = PRINCIPLE AMOUNT *( (1+RATE/100/4)^(4*2)-1)/(1-(1+RATE/100/4)^(-1/3))

ACTUAL AMOUNT (MATURITY AMOUNT) = PRINCIPLE AMOUNT *( (1+8/100/4)^(4*2)-1)/(1-(1+8/100/4)^(-1/3))

ACTUAL AMOUNT (MATURITY AMOUNT) = 65229/-

========================

Now I want to know the FORMULA OF HOW TO CALCULATE RATE OF INTEREST.

Suppose I’m investing 2500 per month in recurring deposit account interest compounded quarterly. My MATURITY AMOUNT IS 65229/-.

But i don’t know what INTEREST RATE I HAVE GOT. I want to find out INTEREST RATE . WHAT FORMULA SHOULD I USE TO FIND OUT RATE OF INTEREST

PLEASE REPLY.

Hi Amit,

I am @ initial stage of plan for investment so Can u plz suggest me for better RD option between SBI & POST Office………..also as per interest rate.

and why????

Thnks,

Vaibhav

RD in banks are more convenient and easy to operate. You can start RD anytime through internet banking, also cancellation is not difficult. In most cases Post office Accounts are still not online. So you will need to visit them for any transaction. Moreover at present Post Offices offer 8.4% interest which is competitive with Banks.