You might have heard stories where a serious medical condition in a family has drained them of their wealth. These are not just stories but can happen to anyone. To guard against such issues – you must buy Health Insurance. The good part is you also get tax benefit on premium paid for Health insurance. In this post we resolve what’s and How’s of Tax Deduction on Health Insurance sec 80D!

How much Tax Benefit I get on Health Insurance?

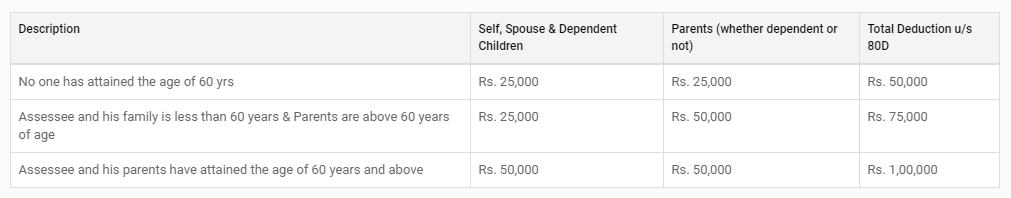

Budget 2018 has enhanced the limit of Health Insurance premium eligible for tax deduction under section 80D for Senior citizens. The limit is Rs 25,000 for people with age less than 60 years and it’s Rs 50,000 for senior citizens. You can also claim Rs 5,000 for Preventive Health checkups. This is within the Rs 25,000/50,000 limit.

You can also claim additional tax benefit on Health insurance premiums paid for your parent.

What’s the Tax Benefit for Health Insurance of Parents?

You can claim additional tax deduction on the premium paid for Health Insurance of your parents. This can be up to Rs 25,000 in case your parents are below 60 years of age and Rs 50,000 in case any one of your parents is above 60 years of age.

But just paying premium is not enough. The policy should have been bought by you i.e. you should be the proposer of the policy. There are cases when people pay premium for an existing policy which was bought few years back by their parents and claim tax deduction u/s 80D. This can land you in trouble. So the best way is to either buy a new policy or write to the concerned insurance company to change the proposer at the time of renewal.

Can premium be split between Husband and Wife for tax benefit?

Suppose you bought family floater Health insurance which has premium of Rs 35,000 which covers self, spouse and children. Now can you split this premium between husband and wife so that both can claim benefit? The answer is NO. The reason being there can only be one proposer for a policy and hence the tax benefit can only be claimed by one.

To get around this you may opt for two separate policies but keep in mind the overall premium might be higher. So do your calculations before deciding.

Also Read: What is the Maximum Income Tax You can Save for FY 2018-19?

What’s the tax Benefit on preventive health checkup?

Tax exemption up to Rs 5,000 is allowed for preventive health checkup of Self, Spouse, dependent Children and Parents. This limit is within the Rs 25,000/Rs 50,000 deduction.

Important Points:

1. The maximum tax deduction u/s 80D can be Rs 1,00,000 in case you buy Health insurance for self and your parents and both you and your parents are senior citizens.

2. HUFs can also claim this deduction for premium paid for insuring the health of any member of the HUF

3. To avail deduction the premium should be paid in any mode other than cash. However the payment for Preventive Health checkup can be done in cash.

Hi Amit. This is Nilesh Health insurance family floater is purchased . Policy is in my name. All family members I e. myself,wife and two children are beneficiary. If the premium is entirely paid by my wife by cheque , my wife can claim deduction under 80d ?

No if the policy is in your name only you can get tax benefit

I HAVE TAKEN POLICY FOR MME MY WIFE AND 2 KIDS , AS MY INCOME IS NOT VERY HIGH, CAN MY WIFE TAKE PREMIUM PAID U/S 80 D FOR HERSELF, PREMIUM IS PAID BY CREDIT CARD OF MINE

It does not matter who pays but what matters is who is the proposer of the insurance (means Purchases the policy and pays the premium).

Hi,

Medical Insurance Premium paid is Rs 24015 my age Yr 61 + Rs 14885 my wife age yr 55 Total 38900 . How much amount will qualify for Income tax benifit

all amount 38900

Sir, whether tax deduction is allowed on basic premium or basic premium plus GST u/s 80D?

Sir,

Whether income tax deduction u/s 80D is admissible only on Basic Premium or on Basic Premium and GST?

Hello!

Can I claim deduction u/s 80D for the premium paid by me for the critical illness policy of my wife? In this policy, my wife is both Proposer and Insured. She has earning below taxable limit.

Please inform

In continuation to above, suppose if I get the name of Proposer changed to Myself then will it make any difference in claiming deduction u/s 80D by me,

that is,

Proposer: Ketan Shah (Myself)

Premium paid by myself.

Insured: My wife.

Please inform

Question:

1) Husband (Ram) pays 7000 for health checkup of self and his parents. He can claim exemption of 5000 in his income tax return under section 80D for preventive health checkup.

2) Ram’s Wife (Sarla) pays 4000 for health checkup for herself and her old parents (Ram’s in laws). She can claim exemption of 4000 in her income tax return under section 80D for preventive health checkup.

Is this allowed or does the IT rule restrict the combined benefit for husband and wife to 5000?

i am a pensioner aged 63. can I claim tax deduction under Sec80D for medical insurance of my son aged35 who is dependent on me financially.plz guide. Thanks

Whether Rs. 5000 for preventive check is for whole of the family or Rs. 5000 per person

for family

Hello Amit

Thanks for sharing the information, always helpful.

Could you please guide that when an insurance company rejects someone’s application then does that company share this data to IRDA? That is, is there a common pool where all rejected applicant’s data is shared for others to verify?

Regards

Amit (yeah, me too 🙂 )

I don’t know if the insurance companies share such information among themselves. There may be cases where one company approves the claim while other approves it according to their policies.

Thanks a lot for such detailed information. One query is there. Suppose policy is brought by mt parents. Now in the next renewal I change the proposer name to myself. Then in case, my parents pay the premium from their account. Will my parents be able to claim tax benefit(as the proposer name changed to my name)?

I don’t thin so your parents would be able to claim tax benefit. As per me You should always avoid these grey areas 🙂

HI amit

I have a two younger sister and both are married , My one sister husband is suffering with cancer of stage-II . He had a job with private sector and Yearly income is 2.5 lac . While my sister is house wife .They are not having that much financial condition . So during two times surgery we had supported her for financial . I just want to know that how i will claim this amount . further I want to know that , How I will shown that My one sister is Dependant on my income. Pl help me for the solution.

As per my understanding you may not be able to show your married sister/brother-in-law as your dependent and hence cannot claim any tax benefit on this amount.

Amit, one of my parent is suffering from severe disease, so how to figure out whether this disease falls in the list of accepted severe medical condition. And she need to take medicines for treatment as maintenance dosage where we need expend around Rs. 5000 – 6000 per month, so how much I claim per annum and under what section of 80…and also what medical certificate required from Government Hospital Doctor etc…

Following diseases are covered under section 80DDB:

Neurological D

Parkinson’s Disease

Malignant Cancers

AIDS

Chronic Renal failure

Hemophilia

Thalassaemia

You need a certificate from specialist from Government Hospital would be required as proof for the ailment and the treatment…

Hi,

I find myself in the below situation:

1. Premium of family floater (self, spouse, child) = Rs 17,000/- [Count against the Rs25,000/- deduction for self/family. So, balance left is Rs 8,000/-]

2. Premium Paid for senior citizen father = Rs 18,000/- [Count against Rs 30,000/- limit for parents who are senior citizens. Balance available after claim is Rs 12,000/-]

3. Premium paid to employer for Top-up of Group insurance (family + parents) = Rs 11,000/-

Question is how & where to include the item#3 for the premium of Rs 11,000/-?

a) Utilize the complete Rs 11,000/- against limits available for senior citizen parents’ head?

b) Split the Rs 11,000/- into per head cost of around Rs 2,200/- (5 pax) and then add the same to respective heads of Rs 25,000/- and Rs 30,000/- limits?

My research tells me that our tax guidelines are silent on this sort of situations, and leaves the door open for interpretations by the tax-payer and the tax-officer.

Your inputs will be helpful.

Thanks,

Ashutosh

You are right. You can do either of option a or b – should not be a issue!

Let Me tell you Mr Amit, You are doing wonderful Job !!! Bravo and Thumbs up for you… CA Yogesh

Thank you 🙂